Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About our Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About our Instructor

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

careercfastudy-tips

13 Aug 2021

As the name suggests, portfolio managers manage investment portfolios on behalf of various clients; for example, individual clients, companies, or employed by larger financial institutions and firms. Let us look at the duties, specializations, and management skills of portfolio managers.

What are the duties of a portfolio manager?

Portfolio managers carry out in-depth research of current events and market trends. In addition, they work with research analysts to determine the effect of these events on financial investments. Research analysts from both the buy-side and sell-side working in investment banks should present investment ideas and market information to portfolio managers. Portfolio managers utilize the information to decide which investments to buy or sell on behalf of their clients.

As a portfolio manager, you will be in charge of the company’s funds. Portfolio managers work with teams of researchers and financial analysts and keep up to date with market and business changes that impact their funds.

In addition, portfolio managers maintain relationships with clients. They are responsible for organizing meetings, such as by phone, email, or in-person, and communicating research, justification for decisions, and investment strategies to clients. Portfolio managers are responsible for adding investments to their clients’ portfolios, managing them, and making decisions to maintain or sell them.

Areas of specialization for portfolio managers

There are several areas of specialization for portfolio managers. Let us explore some common factors that determine specializations for portfolio managers.

- Type of investment vehicles: portfolio managers can specialize in equity or fixed income investment vehicles. Investment vehicles include hedge funds, mutual funds, trust and pension funds, institution funds, and high net worth investment funds.

- The size of the fund: portfolio management designations can be different because of the varying sizes of investment funds. You can work for independent clients with small funds or manage large investment pools by institutions such as banks.

- Investment style: portfolio managers can employ different investment styles. You can specialize in small or large-cap specialties, local and international fund investments, hedging techniques, and value style of management.

Skills needed to be successful portfolio managers

Portfolio managers require some skills to analyze reports and make big investment decisions for their clients every day.

- Decisive: portfolio managers maintain investment portfolios and make decisions on behalf of their clients. To be successful, they should evaluate information and make good decisions that benefit the client.

- Creative and innovative: successful portfolio managers are always a step ahead of others because they are creative. Innovative managers think outside the box to get information on investments that other investors do not see.

- Critical thinking: portfolio managers are presented with large quantities of information to analyze and use to make investment decisions. Critical analysis helps portfolio managers think through each decision’s strengths, opportunities, and potential consequences.

- Experience: you need experience in financial investments, which you can gain working as a financial analyst. Experience as a research analyst will help portfolio managers understand market research and information better.

Portfolio managers utilize expert knowledge and experience to decide whether to sell or buy assets when markets fluctuate on behalf of their companies. According to data from the CFA Institute, at least 22% of CFA charter holders are portfolio managers. Earning a CFA certification does not guarantee a senior management position, but it gives you an edge when seeking entry-level jobs and advancing your career.

Start your journey to earning a CFA charter

To enroll in the CFA professional course, you should hold a bachelor’s degree or an equivalent or be in the final year of your undergraduate studies. You are also eligible to register for the CFA program if you have at least 4,000 hours of relevant work experience or 4,000 hours of the combined university and professional experience.

The next step after enrollment and registration is to start studying for your exam. The following study tips will help you pass your exams.

Start a study routine as early as possible

It would help if you put in a lot of time and effort to attain such a high level of understanding and application skills, and starting a study routine as early as possible will go a long way in helping you achieve this. Therefore, start your studies six to nine months before the exam date to ensure you have enough study time.

Please take note of the core topics and their exam weights

During your study sessions, it is essential to understand the topics that carry more weight in the exams versus those that do not. All the levels in the CFA program focus on the same core topics. Therefore, you should note the core topics that weigh more in the exams you are studying.

Practice taking the exam

The last but equally important step in preparing for your CFA examinations is to practice taking the exam as much as possible. It would be best if you simulated realistic exam conditions while practicing. You will be given a mock exam by the CFA Institute and buy additional resources from Analystprep.com.

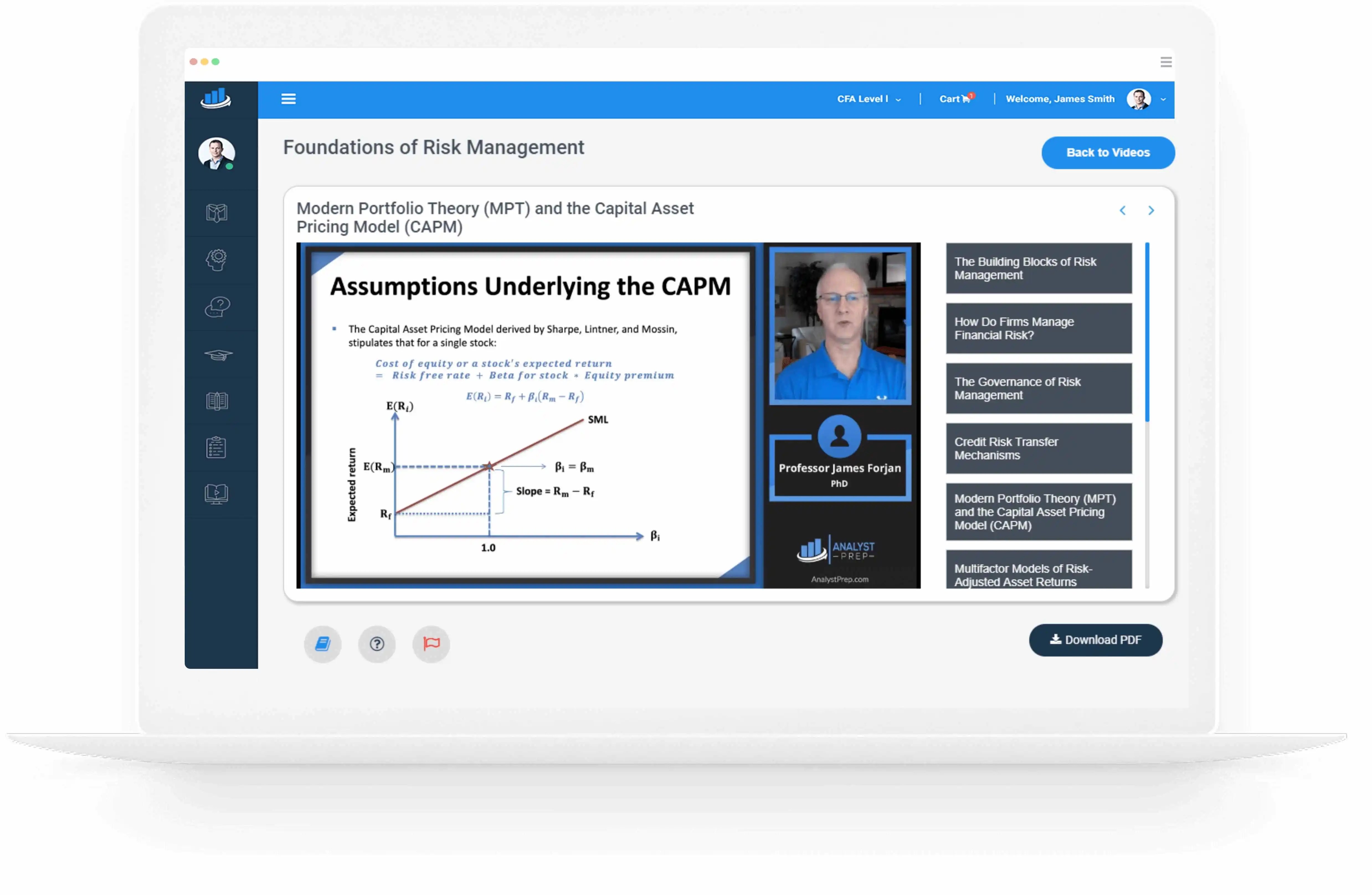

Contact us at Analystprep.com for our CFA study packages to help you prepare for your exams. You will have access to notes and video tutorials from the best professors and an up-to-date sample question bank to help you pass your exams on the first try.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduation Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Hui Ni

2020-12-18

Thanks for the effort and time spent in making these wonderful video! Not only did it help with it academically, it makes me feel motivated and comfortable that have someone guiding me through every chapter after chapter! Appreciated very much! ?

Geoff Graae

2020-12-18

With the help of analystprep I cleared both FRM 1 & 2. The videos posted online are some of the best resources I used and I would recommend them for anyone looking to clear this program. Thank you!!

Nithin Nallusamy

2020-12-09

FRM instructional videos was very helpful for my exam preparation! Prof.James is such a good heart and his way of teaching is impressive! Thanks a lot prof for free YouTube videos...

Isha Shahid

2020-11-21

Literally the best youtube teacher out there. I prefer taking his lectures than my own course lecturer cause he explains with such clarity and simplicity.

Artur Stypułkowski

2020-11-06

Excellent quality, free materials. Great work!

Ahmad S. Hilal

2020-11-03

One of the best FRM material provider. Very helpful chapters explanations on youtube by professor James Forjan.

Trustpilot rating score: 4.6 of 5, based on 54 reviews.

Related Posts